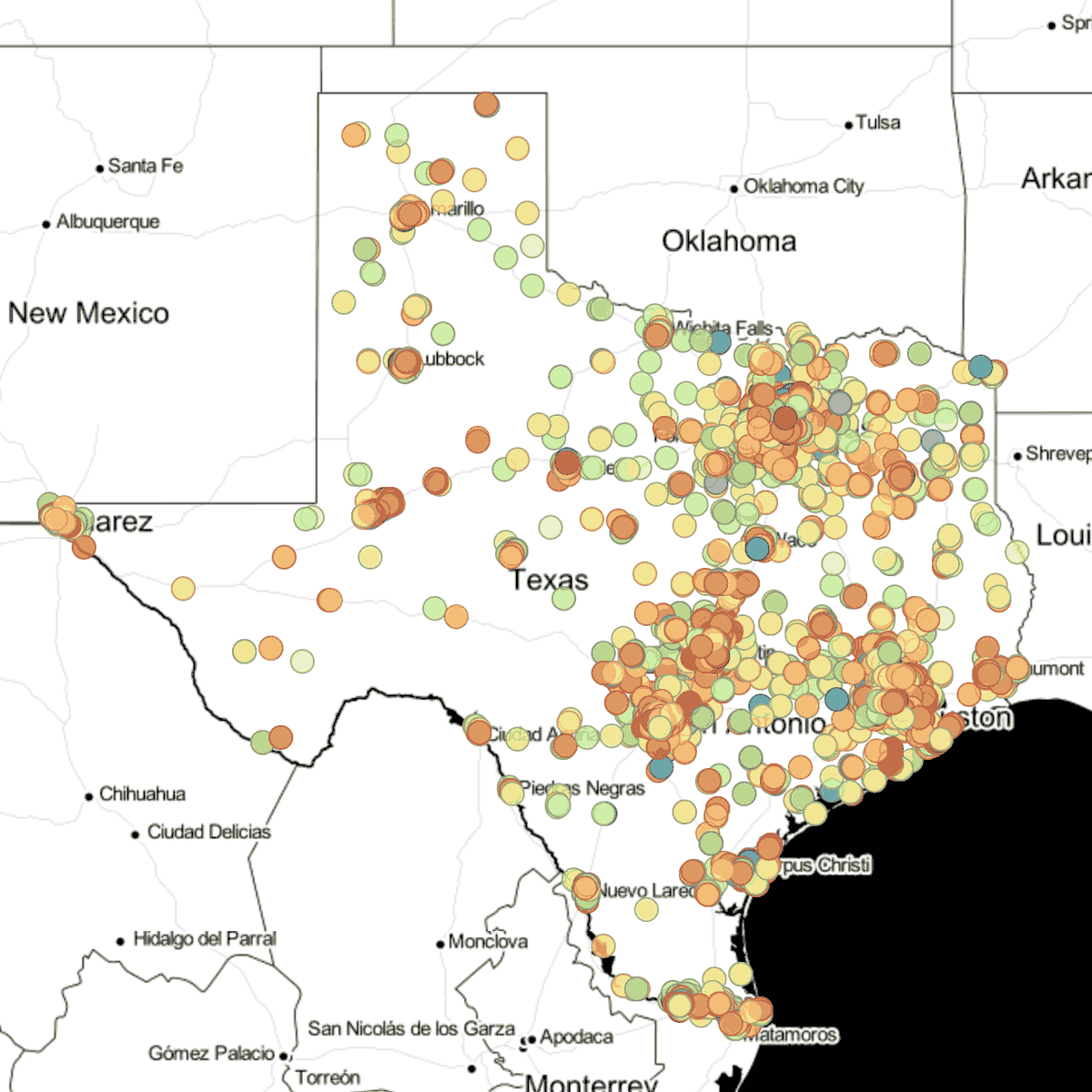

This map helps explore the mixed beverage gross receipts taxes collected by the Texas Comptroller.

It’s important to note that the “Total Receipts” field does not represent the amount of tax due by the taxpayer. Rather, it represents the gross receipts reported for beer, wine and liquor. The current MBGRT rate is 6.7% of the total receipts.

data.texas.gov/stories/s/tj7s-7tc8

A tax at the rate of 6.7 percent is imposed on the gross receipts of a permittee received from the sale, preparation, or service of mixed beverages or from the sale, preparation, or service of ice or nonalcoholic beverages that are sold, prepared, or served for the purpose of being mixed with an alcoholic beverage and consumed on the premises of the permittee.

Homepage: github/texas/tx_mixed_beverages

Geocoding:

Date scraped: Feb. 5, 2026